Pay in & out

in real time

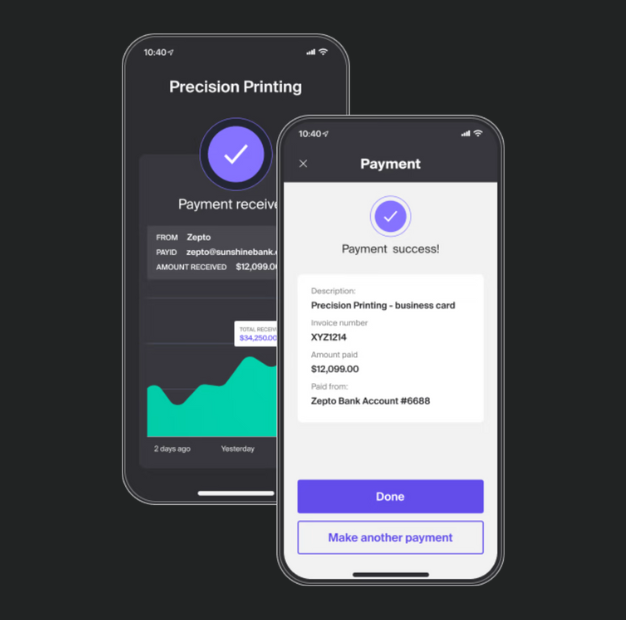

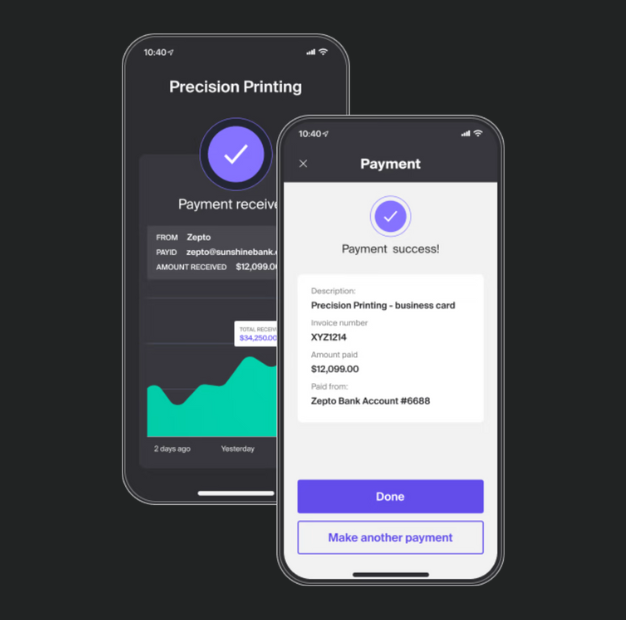

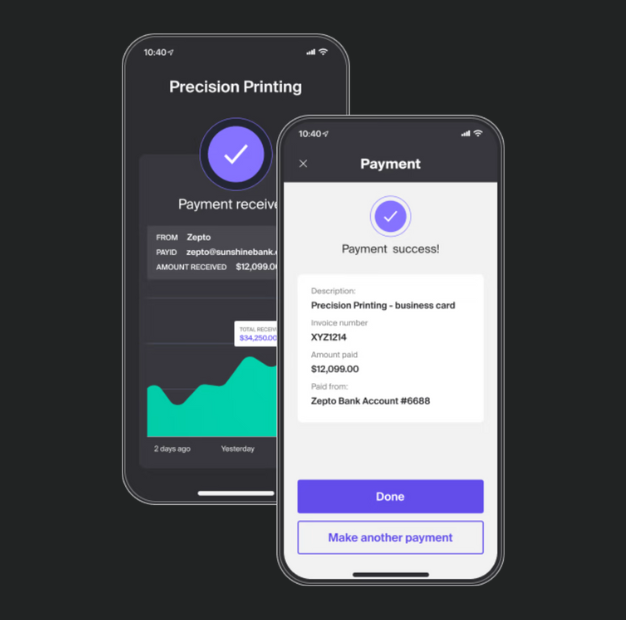

Payments on the New Payments Platform [NPP] can deliver your customers a seamless, real-time digital payments experience. With Zepto's clever API, you can receive and disburse funds in real time on the NPP. When complex enterprise payment flows are at play, every zeptosecond counts.

Speed & Precision

Business hums when money moves fast, with precision, and back-office processes are automated and friction-free. With Zepto’s low cost, high speed, resilient NPP payment solutions, you can configure high-volume, time critical, end-to-end payment flows that flex & scale. Granular, flexible and always on, NPP payments can be instructed to behave the way you want them to.

Better Business

Disburse and receive payments, and have them settle and reconcile in seconds. Improve your customer experience, drive efficiencies through automation, fraud detection, and real-time messaging via our API or webhooks. Know precisely who paid for what instantly, and accelerate your product and service delivery. These are modern payments for modern business.

Reliability & Reachability

Zepto's API provides secure connectivity to NPP payment rails, delivering resilient, scalable, real-time payments with real-time messaging, settlement and reconciliation the moment a transaction occurs. Zepto instantly pre-validates destination bank accounts to ensure they’re activated to successfully receive payments via the NPP.

Tomorrow's payments

We believe the business battles of tomorrow will be won with payments technology available today.

By innovating over multiple payment channels, Zepto provides a seamless path right now to the payment channels of the future. This lets you confidently scale at speed without the worry of your payments system keeping pace.

Zepto is a New Payments Platform (NPP) Connected Institution (CI), and the first PayTech to be an approved AusPayNet Tier 2 BECS Participant (BSB 840 / SPL).

Real-time payouts

WAGES ON DEMAND

Gig workers run micro-businesses, incurring expenses shift-by-shift, so real-time on-demand access to their earnings is vital to them. Take your casual/gig worker payroll experience to another level and retain the very best talent with instant, end-of-shift wage payments 24/7, 365 days a year.

BETTER LENDING

Lenders can disburse loans as cleared funds in real time on NPP payment rails, even on weekends and public holidays. Zepto can automatically verify destination accounts to confirm they are NPP-enabled for security of payment and optimal customer experience. Better lending starts here.

INSTANT REFUNDS

Refunds happen. But they should be fast, accurate, data rich and painless for both the merchant and the consumer. Refund with precision and speed on the NPP, and enjoy a strategic business advantage with a Zepto real-time refund solution.

NPP Need-to-know

What is the NPP?

The New Payments Platform [NPP] is Australia’s real-time payments infrastructure. It was developed via industry collaboration to enable Australian consumers, businesses and government agencies to make digital payments — with near real-time funds availability to the recipient — at any time. It facilitates the clearing and settlements of real-time data-rich payments for the Australian digital economy.

NPP Australia [NPPA] is responsible for maintaining and developing the NPP infrastructure to ensure it meets Australia's current and future real-time payments needs.

NPPA is a wholly owned subsidiary of Australian Payments Plus [AP+] which is also home to the BPAY Group and eftpos.

What are NPP payments?

NPP payments are always-on, account-to-account [A2A] funds transfers that settle almost instantly. Beyond the real-time nature of NPP payments, the NPP was built using ISO20022 [the international standard for financial industry messaging] to enable more data to travel with a payment. Zepto's API is aligned to ISO 20022 enabling standardisation, automation, improved reporting and carriage of data-rich payments, all of which are supported by the ISO 20022 messaging standard.

Examples of NPP payments include NPP payouts, PayID payments, Osko payments and PayTo payments.

What are the advantages of NPP payments?

NPP payments are near instant, data-rich and can be made at any hour of the day, seven days a week, 365 days of the year. Operating at the speed of the digital economy and our online lives, they deliver real-time digital payments experience consumers expect, and the efficiencies that business needs.

As NPP payments can process, settle and reconcile in seconds, recipients can have immediate use of funds improving cash flow.

NPP payments can carry up to 280 characters of reference text for a better customer experience.

They can be cost effective, too, compared to other payment methods.

Learn more HERE.

How is Zepto connected to the NPP?

Zepto is connected to the real-time payment rails of the NPP in two ways:

> Directly connected as a Connected Institution [CI] for PayTo.

> Wholesale access to the NPP as an NPP Participant.

Why choose Zepto for NPP payments?

As the first non-authorised deposit-taking institution (ADI) approved to connect directly to the NPP as a ‘Connected Institution’ for PayTo, Zepto is a trusted payments infrastructure player and a pioneering force in modernising payment experiences.

Zepto powers payments for numerous large enterprises attracted to our blend of fintech agility, accessibility and support underpinned by enterprise grade infrastructure that delivers extensibility, security and stability.

Zepto sits at the intersection of real-time payments and data, with a clear view of "what's possible" when it comes to real-time, account-to-account payments for enterprise.

We firmly believe that the business battles of tomorrow will be won with payments technology that's available today.

Can NPP payments improve customer experience?

We believe great customer experience is everything, and that NPP payments can deepen the customer-merchant relationship, drive trust, loyalty and elevate customer experience.

Unencumbered by legacy technology and thinking, Zepto has built a Financial Cloud Service that sits atop an interchangeable orchestration layer of payment and data channels.

That means no 'legacy', and no batch processing. Just modern enterprise-grade payment infrastructure designed to meet modern customer expectations of the real-time, digital economy.

How reliable is Zepto's API for NPP payments?

Click HERE for a real-time view of our API status and uptime.

Built as a RESTful API using JSON as its data-interchange format, Zepto's API is aligned to ISO 20022 enabling standardisation, automation, improved reporting and carriage of data-rich payments, all of which are supported by the ISO 20022 messaging standard.

Zepto is proudly ISO/IEC 27001 certified for information security, cybersecurity and privacy protection. Read more about the Zepto platform HERE.

Receive mission updates...

Subscribe to our newsletter to stay in-the-know with the latest payment news, expert insights and all things Zepto.